Phillip Gales:

Good morning everyone! For the second interview in our expert series, we're going to be talking with Andrew Lipman from ABS (the American Bureau of Shipping).

Andrew is the Director of Subsea and Mining at ABS, and he's currently working in Shenzhen, China, and he has a fascinating background in terms of the regulatory and compliance side of DSM. We're very excited to hear more about that experience and his experience in China. So, good morning, Andrew.

Andrew Lipman:

Hey! Good morning Phillip!

Phillip Gales:

To get us started, can you tell us a bit about your background and your involvement in deep-sea mining?

Andrew Lipman:

Sure. So my background, stretching back 30 years or so, is in offshore oil and gas. I started in Houston with Hoff Offshore International Service Team working in Africa, Gulf of Mexico, and the North Sea. And then I slowly devolved into shore-side work.

When I had the opportunity in 2008 to come to China to work for ABS, I really snapped it up because China was developing their offshore oil and gas fields. Here, based in Shenzhen and in the Southern China area.

DSM is a sort of an interesting story within itself. In 2015 I was the area manager for Southern China for ABS and my boss at the time said, “Hey, go up to Fujian Mawei shipyard. There we're going to start to build under ABS class a subsea mining vessel.” So that was the first time I had heard the words subsea and mining used together in the same sentence. I had absolutely no idea what that industry, such as it is, was involved in.

“well, if you want subsea mining rules, get busy and write them!”

When I saw the plans, and when I went to Mawei and I started looking at the drawings. I said, “Wow! This is something completely different. You know this is a huge vessel, 227 meters, moon pool, derrick, dry cargo holds, cargo offloading, living accommodations for 180.” So I said well, whatever this thing is, it's certainly not a offshore support vessel, which was how ABS was going to class it.

Then when I talked to Houston, ABS headquarters, I asked what kind of rules can we apply with this thing, they said, “well, you know, it's just a one off. Don't worry about it. It's an OSV.” Yeah, maybe somewhat analogous to an OSV, but it's not one. We need specific rules. That led me down a real deep rabbit hole where Houston basically said, “well, if you want subsea mining rules, get busy and write them!”

Phillip Gales:

So you made them?

Andrew Lipman:

Not alone of course - with a very competent ABS team. That was in 2015 and finally in 2020, we published the DSM rules. We were the first Class Society to publish these DSM rules.

Phillip Gales:

I think this is an interesting area for us to dig into a little bit more. I've been learning a lot more about registration requirements and the need to classify a vessel in order to get insurance, and therefore, in order to effectively get any form of financing. Can you just talk us through the basics of registration? And what is going on there and why it's important?

Andrew Lipman:

Sure. Yeah, I don't want to get too insiderish but the actual term that a classification society uses is, in fact, “classification”.

Phillip Gales:

Classification, then.

Andrew Lipman:

Yeah. No worries; that term actually goes back to a coffee house in London in the 1700s. I believe.

Phillip Gales:

Yes! Edward Lloyd's coffee shop.

Andrew Lipman:

Yeah…but coffee, slash ale, I think…

Phillip Gales:

But yes, classification requirement.

Edward Lloyd's coffee shop, from Lloyd's

Edward Lloyd's coffee shop, from Lloyd's

Andrew Lipman:

Yup. Basically, every nation State that has a maritime flag will require classification of their vessels by a recognized Class Society. That involves following the Classification Society set of rules.

For instance, while you do have offshore vessel rules, you have steel vessel rules. You have MODU rules. But what the classification society is mostly concerned with is safety - safety of life, safety of property, and protection of the marine environment. That involves classification. At the end of the process, the particular ship or offshore rig receives a Certificate of Classification.

Now the owners can go to the Flag State, and register the vessel under that nations flag. So you get a Certificate of Registry from the flag state assuming you have a valid Class Certificate. Does that clear it up a bit?

Phillip Gales:

Yeah, that that makes a lot of sense.

I spent a fair amount of time offshore in the in the offshore and gas industry. So when we talk about a Classification we're talking about a vessel could be classified as for example, a platform support vessel, or it could be classified a drillship. But what happens if it falls in between those? What happens if there's a new type of ship like a production support vessel for mining for deep-sea mining?

How does that work? Do you make something new. Is there a procedure for new classification, or what happens?

Andrew Lipman:

Yes, that's a very perceptive question.

What happens is ABS will communicate with the Flag State, and say, “look, this is a one off. This is a unique type of unit. It just so happens we have unique rules just for this type of rig. In this case, subsea mining.” Most flag states will then be able to Register that rig.

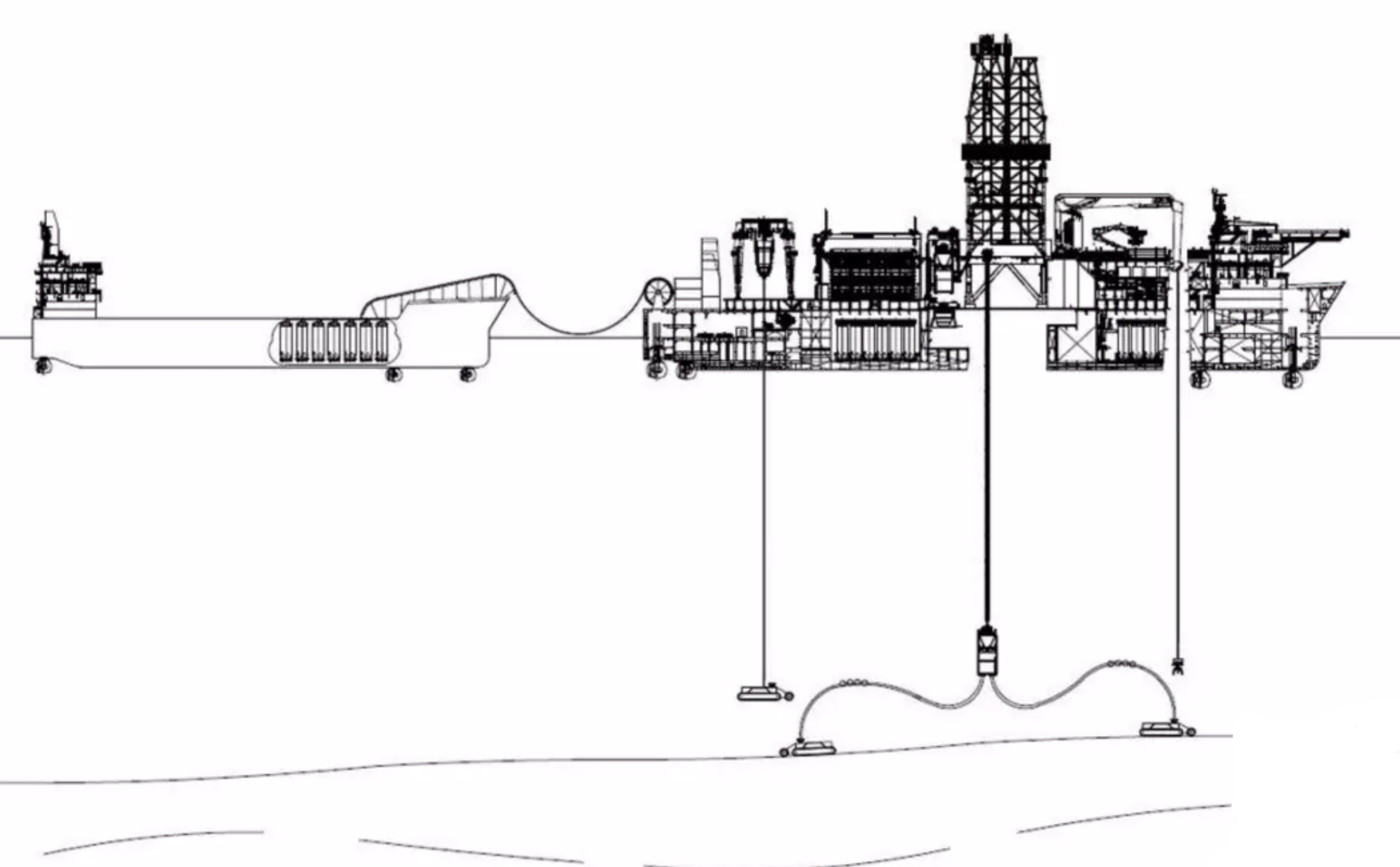

I'll give you a perfect example in the case of Allseas' Hidden Gem. That was a drillship. But drillships have many dissimilarities to a subsea mining vessel. So prior to the conversion, Allseas asked us to look into the statutory and regulatory differences and prepare a conversion protocol to make sure that the Maltese maritime authorities were content to register that vessel as a subsea mining vessel based on ABS class rules.

Allsea's "Hidden Gem" Production Support Vessel, courtesy of Allseas

Allsea's "Hidden Gem" Production Support Vessel, courtesy of Allseas

Phillip Gales:

That makes sense. So where does this leave us as an industry then? Because that sounds like a large amount of work for the Hidden Gem. Does this mean that the Olympia can do something similar, or is doing something similar? Does it forge a path, or will each individual production support vessel need to go through that same process? Where could and where should the industry be going to?

Andrew Lipman:

In the case of conversion of a drillship to a mining vessel, this was the genius of Allseas where they saw that as a possibility rather than to go for a complete new-build Production Support Vessel.

The fortunate thing was that our ABS Subsea Mining Rules were already written and so could ensure that the subsequent conversion would be in conformity and therefore following a standard of safety that all parties could accept.

Phillip Gales:

Right! So the similarity is helpful, even though there's very, very different operations. It's, you know, polymetallic nodules rather than high pressure hydrocarbons.

Nonetheless there a sufficient similarities, and actually sufficient safety considerations within the design of the deepwater drillship that it makes a compelling case.

What about other vessels that will be involved in in deep-sea mining? What about things like the bulk ore carriers that may be transporting the nodules? Is that a similar process?

Andrew Lipman:

Yeah, you mentioned the transport vessels. There's a lot of discussion going on now with these.

We are having some very interesting conversations with potential owners and operators. It's going to be a unique class of vessel for several reasons, not simply just a bulk carrier that transports dry cargo, but this is going to need to do a docking and undocking in the open ocean. That's pretty unique. You're going to have requirements for industry personnel on board (that's called IP). That's a completely different safety code than the bulk vessel bulk carrier was built to in terms of damage stability, lifesaving, load lines, among others. Presumably, the cargo vessels will need to refuel the PSV, this brings in MARPOL requirements.

And then you've got the docking and undocking procedures in various weather conditions which in itself presents some unique dangers.

Phillip Gales:

So if we compare that to the classification process, say for the Hidden Gem, you're saying, “well, we've got a deep water drillship, which operates some equipment via riser, and has 150 personnel on board and helicopter transfers. To convert that into production support vessel, we're gonna do pretty much the same thing, you know, 150 people on board. it's gonna run a riser. It's gonna do some subsea operations, and there's gonna be transfer via helicopter.” I can see significant similarities.

Schematic by NOV (Guido Van Den Bos) of a Production Support Vessel with RALS and Harvesters deployed, offloading to a STARS via tandem (line-astern) offloading.

But when you talk about a bulk ore carrier where you say, well, normally, we have a crew of 12. But now, we want to actually transfer personnel to the production support vessel and back. So now we need additional capacity for industrial personnel. That's such a big differentce to what a bulk ore carrier would do.

And we're not talking about transferring bulk ore from one port to another port. We're talking about loading bulk ore from the production support vessel in the middle of the ocean.

So if I'm understanding it correctly, we're talking about the ability to create a new classification for a production support vessel with relative ease because of similarities. But actually, there's quite big differences when it comes to a bulk ore carriers. Is that right?

Andrew Lipman:

Let me just backtrack again, the conversion of the drillship to a Subsea Mining vessel was anything but simple.

Phillip Gales:

Hmm!

Andrew Lipman:

Yeah, that was a that was a hell of an adventure that we had with Hidden Gem. It actually took more than 6 months, and the reason is, you have 2 different safety codes between vessels and units. So you have what's called the Mobile Offshore Unit (MOU) code, which has very specific safety requirements. And you have the SPS or Special Purpose Ship code, which is completely different.

So what was the problem? The drillship was built under the MOU code and it was converted to SPS code in the case of Hidden Gem.

Phillip Gales:

Right.

Andrew Lipman:

The work involved was not simple. I can say at the end of the day it was very fortunate for all involved that we already had written our ABS requirements for subsea mining vessel, that smoothed the process, so to speak, that made that process possible. Had it not been for that, you cannot, you really could not have converted that particular drillship to a subsea mining vessel. Fortunately, we have some really capable and creative engineers in ABS, who were able to “get the job done, and safely”

Phillip Gales:

Yeah. So if you've got a couple of hundred million dollars lying around, then you could buy a cold-stacked deepwater drillship and convert it into a production support vessel.

I mean…they don't have many of those these days…but if you could…

Andrew Lipman:

You could.

Phillip Gales:

Can you quite easily reclassify something, and can you quite easily build a fleet of deep-sea mining vessels, or is that a significant amount of work that is a near impossible problem to solve?

Cold-stacked drillships

Cold-stacked drillships

Andrew Lipman:

No, not impossible at all. It's you, you know, Allseas was very successful. The Hidden Gem is a great success story. They had great luck with the timing, too. If you know they at the time that they bought the Hidden Gem the actually was called originally the Vitoria 10000. There were drillships cold stacked all over the place. So their timing was impeccable.

“The Hidden Gem is a great success story...their timing was impeccable.”

Phillip Gales:

I think that that leads us onto another interesting area; that you're in Shenzhen and the amount of ship constructions going on there. As you allude to, rig rates and rig capacity has changed significantly over the past 5 years. There were a lot of deepwater drillships being cold stacked about 5-10 years ago, and now we're seeing the exact opposite, where there's almost a complete lack of them. day rates are through the roof.

So flipping it into activity in China, and particularly a lot of the constructions going on in China. Can you tell us more about what you're seeing in Shenzhen? What your experiences there?

Andrew Lipman:

Sure. the Chinese ship building market obviously is quite strong. Not only ships, but offshore units as well. So you've got floating production rigs. You've got drillships, FPSOs, even FLNG now.

Previously Korea and Japan dominated the offshore construction market. China within the last, let's say 10-12 years has come on very strong in in terms of quality, speed of production, and of course price.

Yiu Lian shipyards in Shenzhen, China - a subsidiary of China Merchants Industry Holdings Co. Ltd, from Arnaud de Lestapis

Yiu Lian shipyards in Shenzhen, China - a subsidiary of China Merchants Industry Holdings Co. Ltd, from Arnaud de Lestapis

Phillip Gales:

I think at least I have a very, forgive me, a very Eurocentric (maybe I'll arguably North American / Eurocentric) view of the deep-sea mining industry. It's sort of The Metals Company, Allseas, the GSRs of this world, etc. But when you look at what China is doing, you've got COMRA, you've got Beijing Pioneer, you've got China Minmetals There's what? 6 different licenses, 3 companies. They've got licenses in international waters in all 3 of the major mineral types.

And am I missing something? Like, should there be a focus on Asia, China, Japan, rather than the TMC / Allseas focus that that a lot of the industry seems to have at this point.

Andrew Lipman:

Yeah, you're absolutely right. The 3 big ones that you mentioned, which was COMRA, Beijing Pioneer, and China Minmetals. Yeah, they're very strong in terms of engineering, in terms of production, in terms of research. There's no doubt about that. Need to mention China Merchants Industries, which not only has their own DSM program, but owns 11 Shipyards in China, and operates one of the world's largest energy transportation fleet of ships.

Also like Japan and Korea. They have their own programs and are very, very advanced in certain cases. KRISO, JOGMEC, DORD. So yeah, there's a huge focus in Asia for subsea mining. And I do think that in certain cases, when I talk to people in in North America or Europe, they're kind of missing the picture.

But that's understandable as well. Because there's not a lot of publicity going on in Asia. Nobody's jumping up and down saying , “Look, look at our mining program!”. They're quietly going ahead and doing what they're going to do.

Phillip Gales:

That's a very good point. And of course, as a corollary to that you don't necessarily have NGO push back in the same way.

It's certainly very easy for Greenpeace to protest The Metals Company's operations because they know that the disruption will earn them press. They know that that The Metals Company is known of, and that it will actually attract some attention. Whereas I can't imagine there's an equivalent or equivalent level of activity in China. Certainly a very different business environment.

Is that what shapes this Chinese, deep-sea mining environment? Or are a lot of other factors in involved?

Andrew Lipman:

I'm sure there's factors there that I'm not aware of. I'm a technical person, so I can't speak to the geopolitical aspects of it.

You know, the Chinese have been involved, I mean, they were signatories to UNCLOS, at an early stage. They're heavily represented at the ISA. They're going ahead at their own pace, as the Europeans and North Americans should as well.

USA, not being a signatory to UNCLOS, that effectively bars the USA from dealing in the international area.

Phillip Gales:

That's a whole other one that we need to talk about at some point in time. It's like, I can't understand America perspective, where they simply don't want to be in the room when a whole new industry is potentially about to about to emerge in front of the. But that that's a that's another one.

It does actually segue quite nicely into discussions about the ISA. And particularly, I'm thinking about cooperation with ABS and the ISA and CARMU. Can you talk about that one? Because it feels like a major area of regulation, of classification, and of cooporation.

Andrew Lipman:

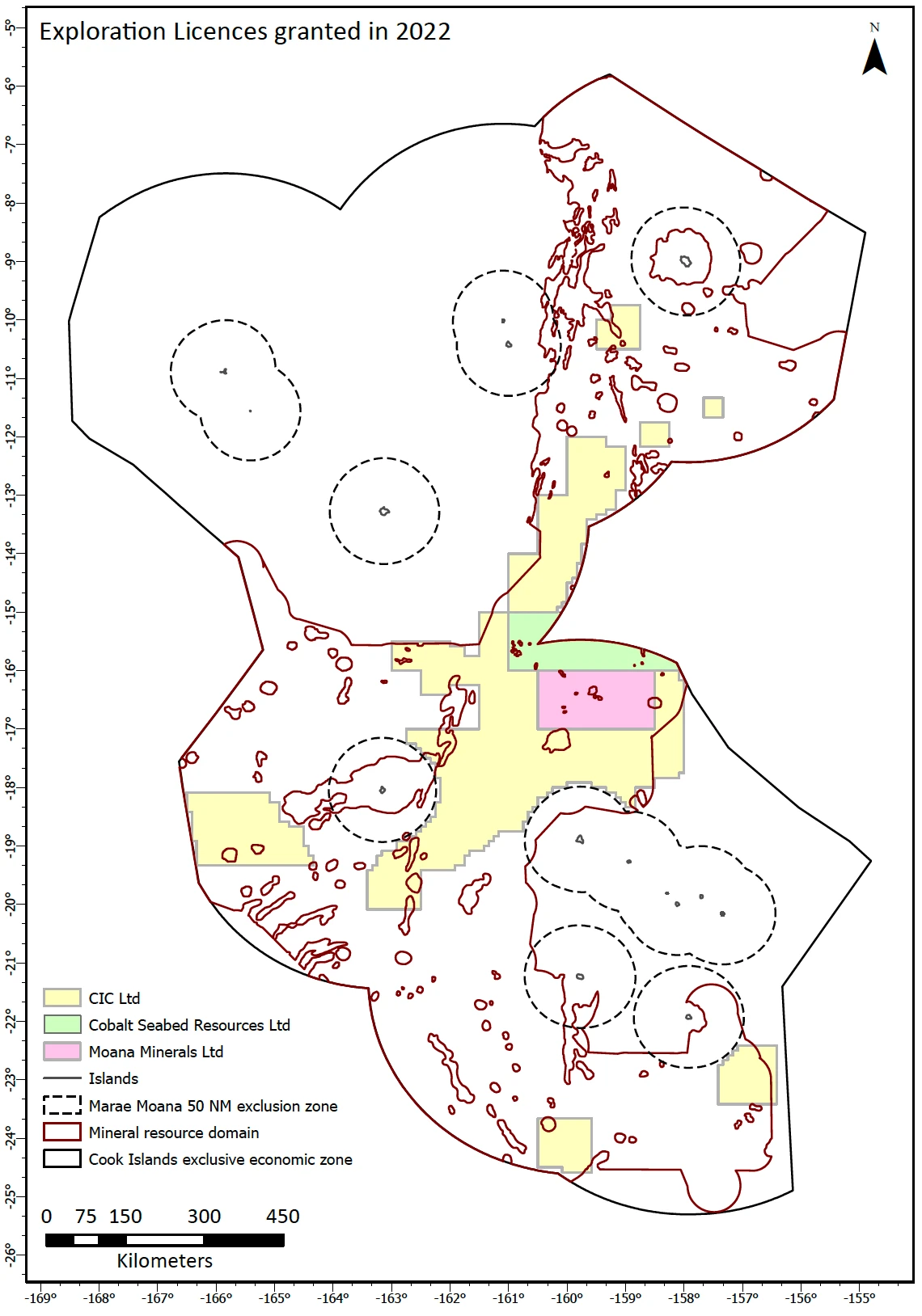

Yes. Please don't forget to mention the Cook Islands Seabed Minerals Authority, the SBMA. I have the honour of being a member of their Licensing Panel, and am more than impressed with their professionalism. Together, as we're setting up this industry, a brand new industry that's not yet into the production phase. All of the stakeholders are interested in very much pursuing a regulatory compliance regime before the very first production goes into effect.

I can't think of another industry that in its, pre-birth stage has set up a regulatory compliance regime. I just can't think of one, not aviation, certainly not offshore oil and gas.

“I can't think of another industry that in its, pre-birth stage has set up a regulatory compliance regime.”

Phillip Gales:

No, I can't. I'm thinking back to the early days of NASA. I'm thinking about the Apollo project, and so on. That evolving industries have to go through a process of sort of trial and error of.

Andrew Lipman:

Yeah.

Phillip Gales:

Yes, yeah. I was gonna say, you don't want to fail. But in in so many cases you can only learn by failing that it almost feels like you can't effectively progress without doing that. And you're right. I cannot think of an industry.

I can think of those that definitely haven't done that. I'm sat here thinking about ChatGPT, and thinking about generative AI, and just wondering what the hell is being released or unleashed upon the world in terms of AI. The exact opposite.

But I cannot think of an industry that has been forced to jump through hoops like this.

Andrew Lipman:

Yeah.

Phillip Gales:

That due to a range of valid pressures is forced to prove itself to such depth.

Andrew Lipman:

It's a great thing that the regulators of DSM are doing; I respect so much the people that I've dealt with at the ISA and at the Cook Islands SBMA. They're trying to do things the right way. They're getting stakeholder involvement in in their Mining Code, and their standards and guidelines, and that can only be a good thing.

Phillip Gales:

I mean, I'm pretty guilty of bashing the ISA, and being frustrated particularly with things like the data. But when you actually think about what it has achieved and the way it has been able to issue licenses, the way in which it is being able to bring developing nations on board and give them an opportunity to benefit from this. I think it's absolutely tremendous. It has done an amazing job.

Andrew Lipman:

100% agree. 100% agree.

Phillip Gales:

Yes, sorry. ABS involvement in the in the ISA. Maybe you can speak more to that.

Map of Cook Islands Exclusive Economic Zone and licenses issued

Map of Cook Islands Exclusive Economic Zone and licenses issued

Andrew Lipman:

Yeah, so, interestingly enough, we've been cooperating for years now. And as recently as last month in April we had the Technology roadmap session in Porto, Portugal, which I very much enjoyed taking part myself and and meeting with the with the other stakeholders. But at that point I think we had a good agreement with ISA, and in general, that the technologies that get deployed in the area in the international area shall be certified, you know, by a third party. And there's there is definitely a reason for that.

You can take the example of, let's say, Ocean Gate, and their manned submersible. That fellow slipped through a gap, you know, human occupied vehicles in the open ocean fall into a regulatory gap. There's nobody in charge, and there's nobody to say, “Hey, before you put people in a submersible and go diving in 4,000 meters, we need to see some kind of certification!” No, and this fellow, the CEO of that company, was very disdainful of the certification process, He thought the certification process was time consuming and counterproductive.

You know the parable about the Emperor's new clothes, right? The tailors were so afraid of the Emperor getting angry, they made an invisible suit of clothes. Well, when you want to know the objective facts about the Emporers suit of clothes, you don't ask for the tailors' opinion.

In other words, you don't ask the contractors how reliable their system is you. You go to a third party. That's our role. And fortunately, I think, the ISA and SBMA are is very much attuned to that.

As to the role of class society in in certification of the equipment and the rigs that are gonna work in the area.

ISA Expert Workshop, hosted by INESC TEC in Porto, Portugal, from ISA news

ISA Expert Workshop, hosted by INESC TEC in Porto, Portugal, from ISA news

Phillip Gales:

I certainly am very aware of that from the oil & gas industry, and the evolution from quite wishy, washy objective-based to very prescriptive rules-based regulations. There's a huge difference. And there's a huge difference in terms of the requirements of the safety culture that's forced upon the operators.

Andrew Lipman:

Yes.

Phillip Gales:

But you make an interesting point about the Emperor's clothes, and don't ask the tailor, because the tailor will say what the Emperor wants <to hear>.

So how would you see this? Do you see ABS's role as being integral to the evolution of this industry in terms of not being the tailor? Is that is that where you're going to with this?

Andrew Lipman:

Yes, consider that all of the mining contactors face tremendous time and money pressures. Cutting corners in terms of safety and reliability sometimes is just human nature. That's where we come in. We don't have commercial or time pressures, and can objectively evaluate the contractors' equipment, vessels, plans of work and so on.

“(ABS) can objectively evaluate the contractors' equipment, vessels, plans of work and so on.”

Phillip Gales:

That that makes a lot of sense, and then sort of broadening from the classification side, what else do you think the industry needs in terms of in terms of quote/unquote, “not asking the tailor”? What do you think the ideal structures and/or organizations, etc, would be?

Andrew Lipman:

Yeah, that's another interesting field, you know, in as you're an oil and gas guy as well, you're very much aware of API (the American Petroleum Institute).

So API has got hundreds of specific recommended practices and standards for equipment and for procedures. Everyone refers to that. Whether it's Norway, whether it's China, whether it's USA. Everybody defers to API in terms of standards, and that's an industry organization. So you have industry experts. You have academic experts. They all come together and they write the standards. I would love to see something like that happen in our subsea mining industry. And there is some. There is some work going on in that regard.

Phillip Gales:

I mean, when I think about areas of concern one for me is that this is a completely new industry, which means you don't have the depth of talent experience and personnel that you get with other industries. We're building it as we go along. And so suddenly, it comes to things like training new personnel.

You talked about Allseas, you can talk about the Hidden Gem as deep water drillship, but it's not. It's now a production support vessel. Do you still have a Toolpusher on board? Do you still have a Driller? Do you still have an Assistant Driller? What does the hierarchy look like? What does the safety training look like? How do you implement a safety culture? Is it the same as offshore oil and gas? Is it different? Do we need something different? Where do they get that safety training from?

I just think there's there's a ton of soft aspects that need to be figured out, if we're going to train people and have competent effect and safe operations.

Andrew Lipman:

Yeah, very much agreed. So you can sort of circle back to that API analogy, to a subsea mining institute, so to speak, that has input from everyone; from regulators, from academics, certainly from industry, from us third-party type people and come up with it with a nice set of recommended practices, standards in terms of equipment, safety and reliability.

And yeah, the HSE culture that's so prevalent now in the offshore oil and gas industry, I can tell you from personal experience that was not there 30 years ago. You know, it's been a work in progress. So let's not retread the same ground and make the same mistakes. I think that's where we're all going with this.

Phillip Gales:

I think it's a really important point, because whilst we're not dealing with hydrocarbons under pressure, and therefore the much larger risks that you see in offshore oil and gas don't exist in the same way in in deep-sea mining. There is certainly no risk of something like Deepwater Horizon or the Gulf oil spill. These one-off Black Swan events - extremely rare, though massively impactful - could not occur in deep-sea mining. The actual day to day incidents and the actual stuff that really does impact humans, their lives and families, etc, is the same in deep-sea mining as in offshore oil and gas though. Forgive me for saying, but it's the same dumb stuff. It's slips, it's trips, it's falls, it's not holding on to the handrail.

When I first started in oil and gas industry, I saw one of my friends put their hand up to try and steady an ROV umbilical reel during a heavy lift. It's about 13 tons, big thing 2-3 metres in diameter. Started swing in the wind. Instead of trying to steady with a rope, he put his hand up to try and stop it, which is, you know, against regulations, and almost lost 2 fingers. The sort of thing that happens offshore, whether it's offshore and gas, or whether it's, installing offshore wind, it's exactly the sort of risk.

And so those are the things we need to train people to avoid when it comes to deep-sea mining, because you have exactly the same slips, trips, falls, heavy lifts, etc. exposures.

Andrew Lipman:

What very good point, and one more caveat when it comes to deep-sea mining versus oil and gas rigs. For the most part you've got a HELO Evac as possibility, right? If you got a serious injury.

Phillip Gales:

Good chance.

Andrew Lipman:

Rescue an injured guy with a Helo? Generally not in offshore mining, you know. You're out of helo range. So 5 days on the boat <to shore>, best case scenario a few days on a vessel to a Landside hospital.

Phillip Gales:

So start staffing up PSVs with doctors and trauma kits?

Andrew Lipman:

Again. We're back to this industry standard. This is one area a Subsea Mining Institute could address. Physical security of the operation from pirate/unauthorized organizations is another. Let's find best practices. Whatever a group of experts deem to be best practices - medical facilities, operational security etc. Well, that's it, you know. Let's get that that codified and accepted by the industry. And I'm sure that all of the major players in the Industry,at least the ones I've talked to, so far I have not met one cowboy, and I hope never to meet one.

Phillip Gales:

Absolutely agreed on that one. But it does lead me to another question, which is, you know, I came from the operating side of oil and gas. I have some friends in the project side of oil and gas, you know, working out what the ideal location was of a refinery, or calculating and designing the flow lines, etc.

Are we as an industry focusing too much on the project side? Is anyone seriously looking at what it means to operate a production support vessel? We'll be operating 24/7 in the middle of the CCZ, as you say, 3, 4, 5 days sail from land. No chopper ride to land because it's far too far.

Is anyone focusing on that? And are we missing a major part of the puzzle in terms of the actual practical 24/7 operations.

Andrew Lipman:

I would leave it to the experts. And I do know that, you know, there's some really fantastic professional people that are that are involved on the project side.

One thing that sort of jumped out at me, as I look at some of the plans of work of the various organizations is, their timeline is off in terms of getting the transport vessels online. So if your project needs X number of transport vessels to service the cargo requirements of the PSV, you better have them ready at the same time as you start your mining.

“their timeline is off in terms of getting the transport vessels online”

Phillip Gales:

I'm going to paraphrase that; we're in a place where we could harvest nodules well, with good, reasonable, minimal impact. We can certainly lift them <from the seabed>. Okay, we can get them into hold of the PSV. We can probably process them as a whole host of flowsheets and various processes are being proposed there. Many of them are reusing existing facilities, etc.

But there's a gap in between, in that, how do we get <nodules> from the PSV, to the processing facility to the refinery?

That's what you're saying is an area that we need more focus on, is that right?

Andrew Lipman:

Yeah. Well, I've brought that up to 10, 15 people, and so far their reaction has been sort of like a wide-eyed stare like “Wow! Really? I need to think about that?”

If you wanted to build, if you had the design ready to go today, and you decided to get the ship built and laid the keel today, you've got to wait at least a year or more for delivery, and that's IF you can find an open shipbuilding berth. So your timeline is a bit off.

If you load the nodules on the PSV, and you can't unload them, then everything comes to a stop.

Phillip Gales:

You get yourself into this loop that we talked about earlier, that you've got a new type of bulk ore carrier, the STARS concept, that requires not deviations, but significant modifications to a standard bulk ore carrier, in order to be classified, therefore, in order to get insurance, get flag, etc. And it's just far enough away that you can't simply use a bulk ore carrier. There's significant work that needs to be done, and therefore you likely need a new build. And you're talking about 2 years of delay.

Andrew Lipman:

Best case scenario. 2 years.

Phillip Gales:

YES! STARS, Shuttle Transport And Resupply Ship - nice acronym! Best case scenario, 2 years.

Andrew Lipman:

Yes.

Phillip Gales:

That's fascinating.

Andrew Lipman:

That's the only answer I've got. I've never gotten, “no, no, no, we have this situation well in hand.” I haven't had one major operator said, “no, no, nothing to worry about. We can transport the cargo. No problem.”

They've all just kind of looked back at me with a wide eyed stares.

Phillip Gales:

I've had a similar rection when I've spoke to a couple of friends who were in the Navy, and I was talking to them about RAS or replenishment-at-sea. Another one - I talked to a couple of people about offloading oil from an FPSO. You get this moment where people say, “well, yes, you know, hypothetically, you just do this, and this, and this. But…”

Andrew Lipman:

Yeah.

Phillip Gales:

Practically, it's a hell of a lot harder. You've got these large vessels at sea. You've got a risk of collision. You've got heavy equipment. And you want 2 of them to maneuver close to each other in a safe way. And yeah, it's much, much harder than sounds.

I also just get the two-word answer of “Yokohama Fenders”. That seems to be one that I get - “fenders overboard, and we'll come alongside them to offload”. I don't know who needs to be talking or who needs to be listening, or what needs to be coordinated around that, then.

Offloading examples:

Line-astern offloading of oil from an FPSO

Line-astern offloading of oil from an FPSO

Two vessels alongside performing a transfer

Two vessels alongside performing a transfer

Conveyor offloading of bulk ore

Conveyor offloading of bulk ore

Andrew Lipman:

It's on such a case-by-case basis. So each of the operators has their own idea of how to handle this. It's just that, I think if you step back a little bit and you look at the big picture. Versus where we were at, say, even 5 years ago when everybody was so concerned about the mining systems themselves. They hardly consider the “routine” aspects of offloading and transport. The focus was on the subsea tools, the Vertical Lift System, the dewatering system etc. And you can understand this is focus on new technologies.

But transporting? Oh, yeah, that happens a thousand times a day in all parts of the world. Could not be a problem.

Now, all of a sudden, you know, Boom! I think people have figured out that that was a gap in their thinking, and certainly in their timing.

Phillip Gales:

Yeah, that that makes sense! Well, I'm aware that it's getting towards the mid-morning in in China your time, so business is starting to hot up.

Is there anything that that you want to leave us with? Or are there any other areas that you wanna chip in on.

Andrew Lipman:

My happiness, let's say, is to be, you know, one of the facilitators, or at least one of the early adapters of this fascinating industry.

You could probably get the all the DSM experts in the world in one room, maybe 200 people in that room, and you you've covered, all the movers and shakers. I've made personal friends with many of them, and I certainly admire 99% of the people I've met in this in this industry. I'm humbled, in fact, I'm honored to be to be associated with so many interesting and technically competent people.

“My happiness is to be one of the facilitators, or at least one of the early adapters, of this fascinating industry”

So yeah, that's my closing thought.

Phillip Gales:

I completely echo that.

I was chatting with Gerard at The Metals Company a couple of months ago. I think I shocked him because I said, “you know, Gerard, this is like meeting Colonel Drake from the 1860s at the start of the oil industry. You're building a new industry!”

This is going to be a fascinating, massively impactful industry that really benefits the world.

Andrew Lipman:

And safe.

Phillip Gales:

Yes! Andrew, thank you so much your time. It has been an absolute pleasure!