On Tuesday January 9th 2024, the Norwegian parliament voted 80-20 in favour of allowing exploration for seabed minerals in their Exclusive Economic Zone (EEZ). This makes Norway the second country in the world to permit exploration for subsea minerals after the Cook Islands.

Whilst China and the US frequently clash over critical minerals, we believe that Europe increasingly leads the world in deep sea mining, and will dominate this source of critical minerals.

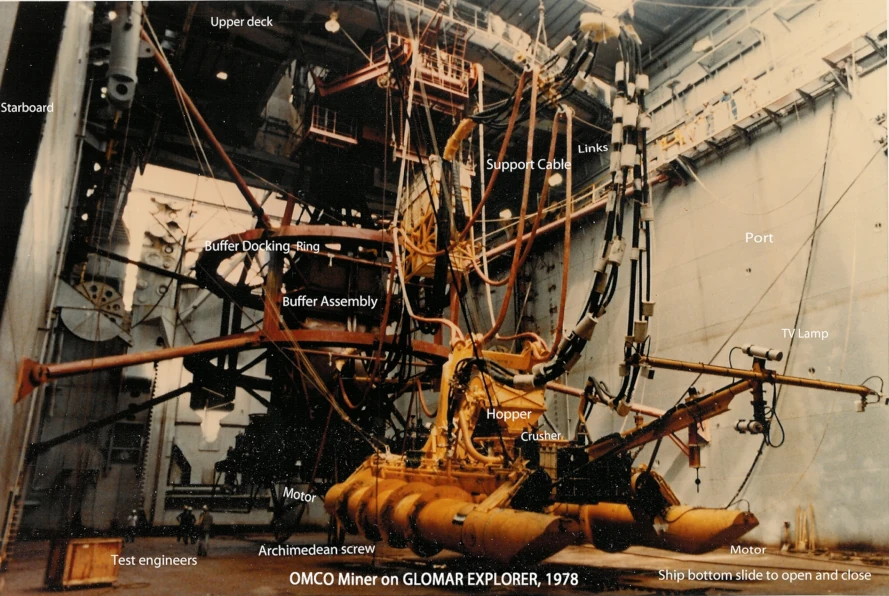

Early US Innovation

Modern deep sea mining began in January 1974 with the formation of the Kennecott Consortium. For many of these early years, the industry was dominated by US companies, including Lockheed, Kennecott, US Steel, and Amoco (Standard Oil).

Despite operational and technological successes, these early consortia were unsuccesful due to a combination of falling metals prices and lack of international regulations. It would take a number of decades before the United Nations Convention on the Law of the Sea (UNCLOS) and eventually the International Seabed Authority (ISA) provided a framework for exploration.

Crucially, the US was involved in the drafting and negotiations of UNCLOS from 1973-82, but never ratified the agreement as it was seen to be unfavorable to American economic and security interests. The result is that the US was absent from the formation of the ISA in 1994, and has been relatively absent in the subsequent development of deep sea mining.

ISA Licenses

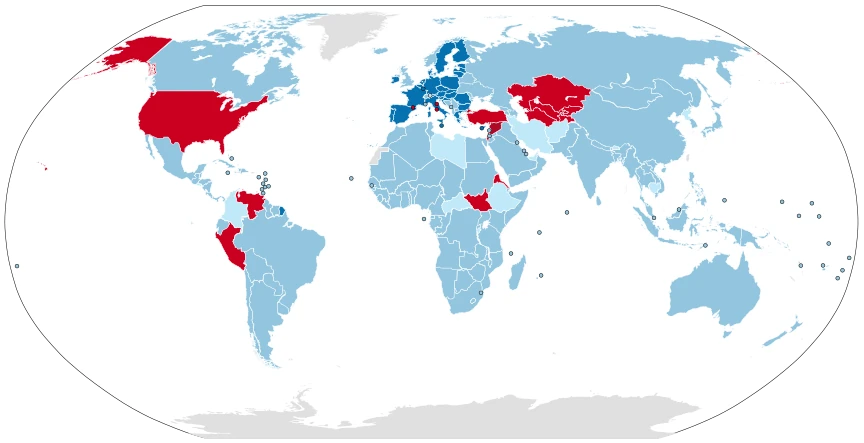

The ISA began issuing subsea mineral exploration licenses in 2001, with the first going to national agencies representing Russia, Korea, China, India, France, Japan, and a federation of mainly Eastern European states. The US was absent from these initial license rounds.

From 2008 onwards, the ISA began issuing licenses to private firms sponsored by nation states. These were initially from developing island nations of the Pacific, including Nauru and Tonga. Subsequent licenses were issued to private firms from countries including Belgium, Singapore and Kiribati. "UK Seabed Resources", a UK subsidiary of the US defence giant Lockheed, was granted 2 licenses in 2013 and 2016. This represents the US's only international activity in subsea mining.

Chinese Investment

Whilst US interest and investment in ISA-regulated licenses has languished, China has been extremely active and aggressive in acquiring licenses for subsea minerals via the ISA. Various state-backed entities, including COMRA, CMC and BPHDC, hold licenses for Polymetallic Nodules, Seabed Massive Sulphides, and Cobalt-Rich Crusts in various zones and regions around the world.

America Wakes to a Critical Minerals Crisis

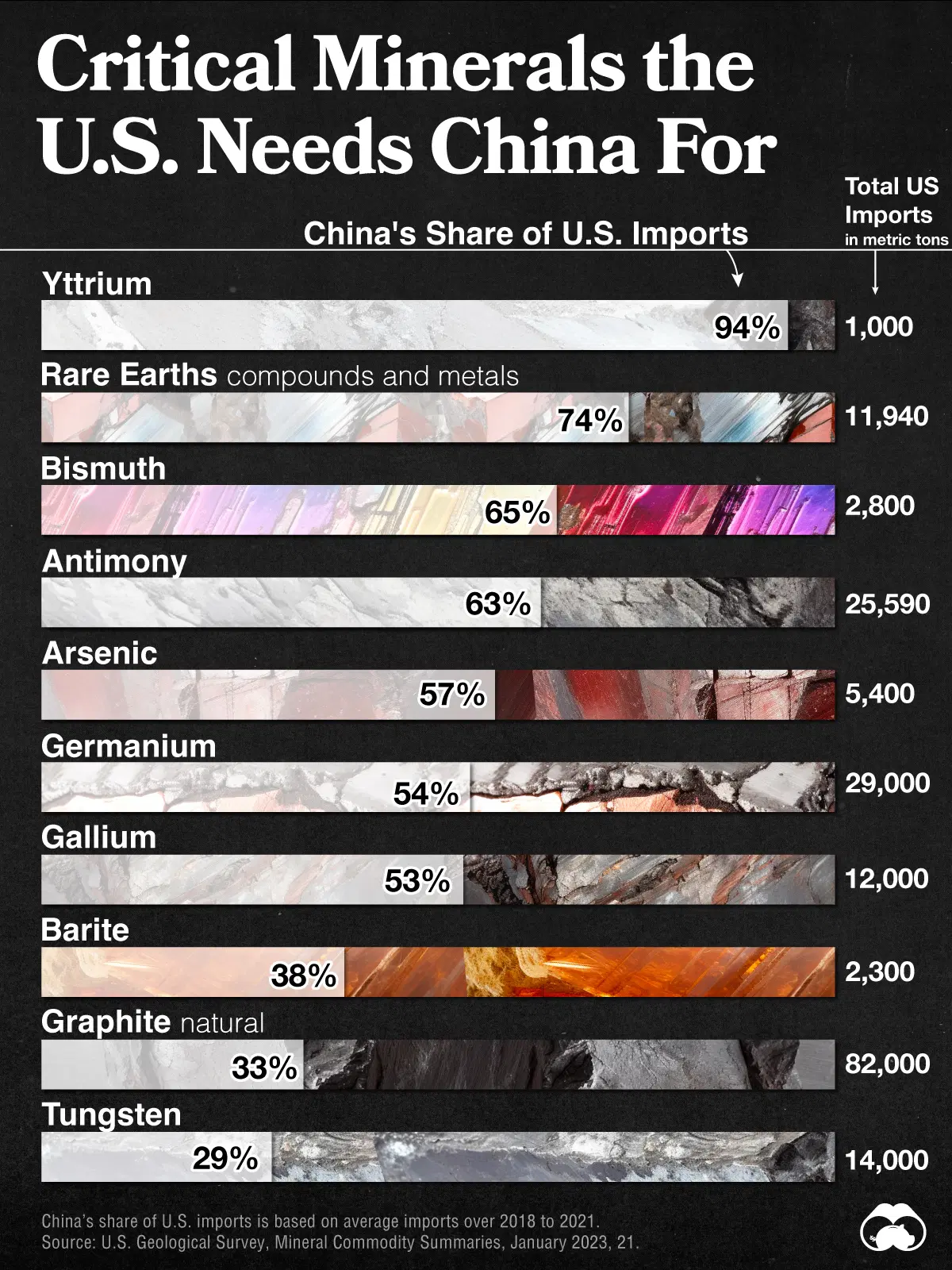

Worldwide consumption of rare earth and other critical minerals has grown exponentially over the past few decades. Growth has been driven by increasing production of electronic devices, combined with electrification of cars, and increasing demand for green energy via wind turbines and solar panels. These products all require a variety of rare and unusual metals that the US neither produces nor refines domestically.

China has positioned itself to source and refine these metals, leaving the US precariously dependent upon China for critical minerals:

Worldwide geopolitical tensions from 2022 onwards, including the war in Ukraine featuring increased usage of drones and electronic warfare, hostile posturing towards Taiwain, the implementation of the Inflation Reduction Act in the US in 2022, and increasing tension between the US and China, has further exacerbated this tension.

US leaders are increasingly realising that their industrial and military base is dependent upon a range of metals that can only be sourced via their main competitor.

The Washington Post wrote a groundbreaking article in October 2023 that highlighted US dependence upon critical mineral supply chain and the increasing Chinese dominance in deep sea mining.

European Industry Quietly Progresses

Despite the increasing concern and rhetoric coming from the US and China around critical minerals, European companies have been quietly learning, building and developing expertise in deep sea mining.

The Vancouver based "The Metals Company" is increasingly the face of the deep sea mining industry, driven by a combination of their significant lead, top-quality license blocks, highly skilled staff, and charismatic Founder / CEO. However, behind this media blitz are an array of huge (and often private) European companies that build the physical equipment and hard tech:

In particular, European companies that have built significant expertise in dredging, offshore oil and gas, and offshore windfarms, are transferring that expertise to deep sea mining:

- DEME Group (a Belgian contractor in offshore energy, dredging and marine infrastructure) holds licenses in the CCZ via their subsidiary GSR. They have also developed "Patania II", one of the leading Harvesters

- Allseas (a Dutch offshore pipelay and subsea construction company) has partnered with The Metals Company and is developing the Hidden Gem Production Support Vessel along with a Harvester

- Loke (a Norwegian license holder) holds licenses in the Clarion Clipperton Zone and intends to explore the Norwegian EEZ

Within this context, the Norwegian decision to allow exploration of subsea minerals is an unsurprising and logical move that builds on decades of European offshore technology and expertise.

US Absence vs Chinese Investment

Despite increasing concern around critical minerals supply chain and national security, US interest in deep sea mining has continued to be muted and uncoordinated.

In March 2023, Lockheed sold their UKSR assets in the CCZ to Loke, meaning that the US has no international subsea mineral licenses and no operating companies. China meanwhile has 3 large operators, and 6 licenses spread across all 3 mineral types in all of the main zones / basins.

One outlier is that Transocean, a US company and the world's largest operator of deepwater drilling platforms, entered the deep sea mining arena in March of 2023 via a joint venture with DEME-GSR. Transocean has faced declining deepwater rig rates and low platform utilization over the last eight years, and we believe that the move into deep sea mining offers a lucrative opportunity to diversify revenues with their existing platforms. That said, they are 5 years behind Allseas, who entered a JV with TMC in 2019.

Conclusion

Whilst the US and China increasingly clash over rare earth elements and critical minerals, European companies with significant offshore expertise are developing the technology and expertise to dominate the deep sea mining industry.

European companies have decades of experience in offshore oil and gas, pipelaying, dredging and installing offshore windfarms. This expertise is directly applicable to the large offshore operations required for deep sea mining industry, and these major players have dedicated assets to developing the requisite expertise and technology. The result is that the leading Production Support Vessels, RALS, Separators and Subsea Harvesters are all European.

Deep sea mining is a complex and asset-intense industry, and this technological lead means that European companies are likely to dominate the industry as it opens up.

We believe that the Norwegian decision to allow for exploration of subsea minerals in their EEZ merely represents the next evolution of this European technical lead in deep sea mining.