Norway Announces Seabed Mining Regulations

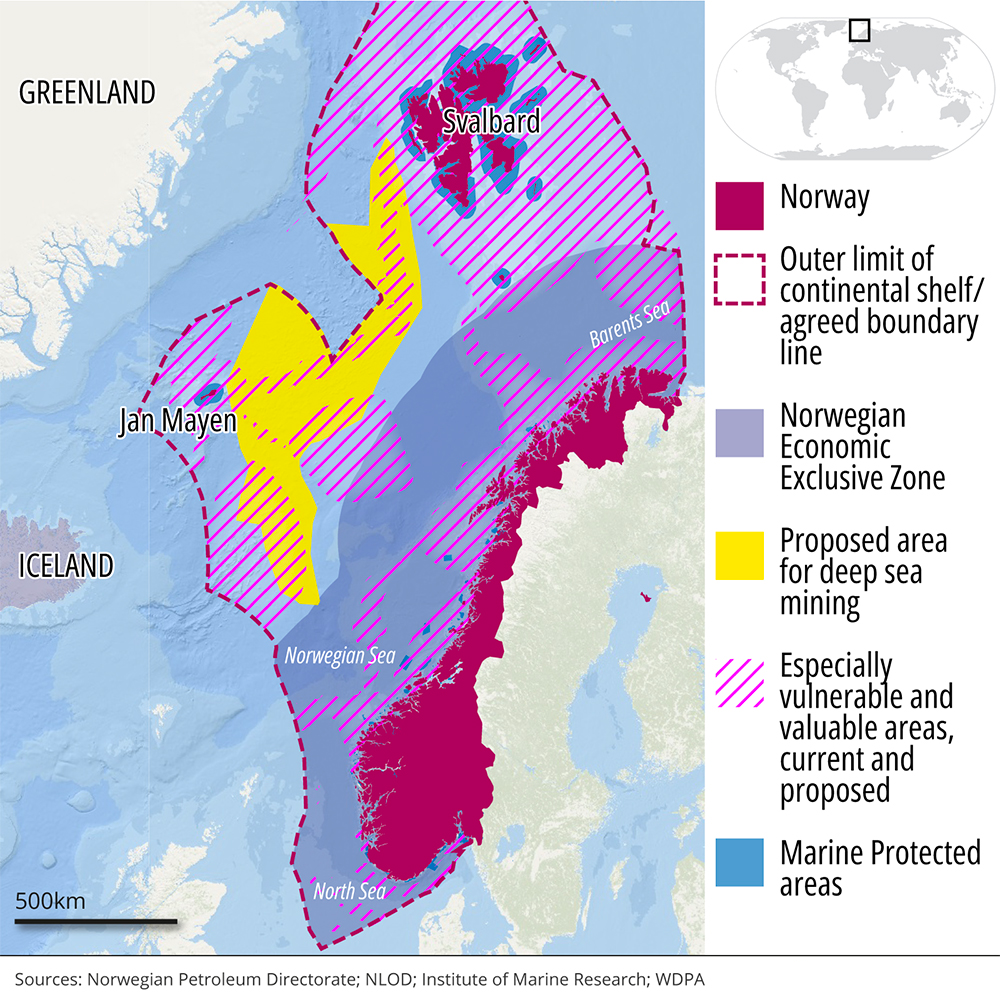

Norway announced in December 2023 that they would allow seabed mineral exploration in the Northern part of their Exclusive Economic Zone (EEZ). The proposal will be formally debated in parliament on January 4th 2024, followed by a vote.

Norway already has significant offshore oil and gas production; producing around 2mln barrels per day, making it the world's 13th largest oil producer. The Norwegian state has used oil revenues to build the world's largest Sovereign Wealth Fund, which is currently valued at $1.4 trillion USD.

Insiders indicate that the government hopes to replace declining oil and gas revenues with deep sea mineral revenues, by reconfiguring existing offshore expertise for deep sea mining.

Transocean Enters the Fray

Transocean, the world's largest operator of deepwater drilling platforms, entered the deep sea mining arena in February 2023 with an investment in GSR DEME. Transocean agreed to contribute the "Ocean Rig Olypmia" deepwater drillship, along with a cash investment.

The majority of deep sea mining companies have plans to use deepwater drillships as their production support vessels. For example, The Metals Company is working with Allseas to convert the Hidden Gem deepwater drillship into a production support vessel.

Deepwater drilling has been in an 8-year downturn, with deepwater drilling platform utilization hitting a low of 65% in 2018. Macroeconomic trends including a low oil price and decreasing demand for oil have made deepwater drilling increasingly unattractive, leaving Transocean with a large fleet of expensive assets. Their move into deep sea mining likely represents an attempt to diversify revenues and recapture a technology lead that they have increasingly forfeited to Allseas and other operators.

TMC Released NORI-D Collector Test Findings

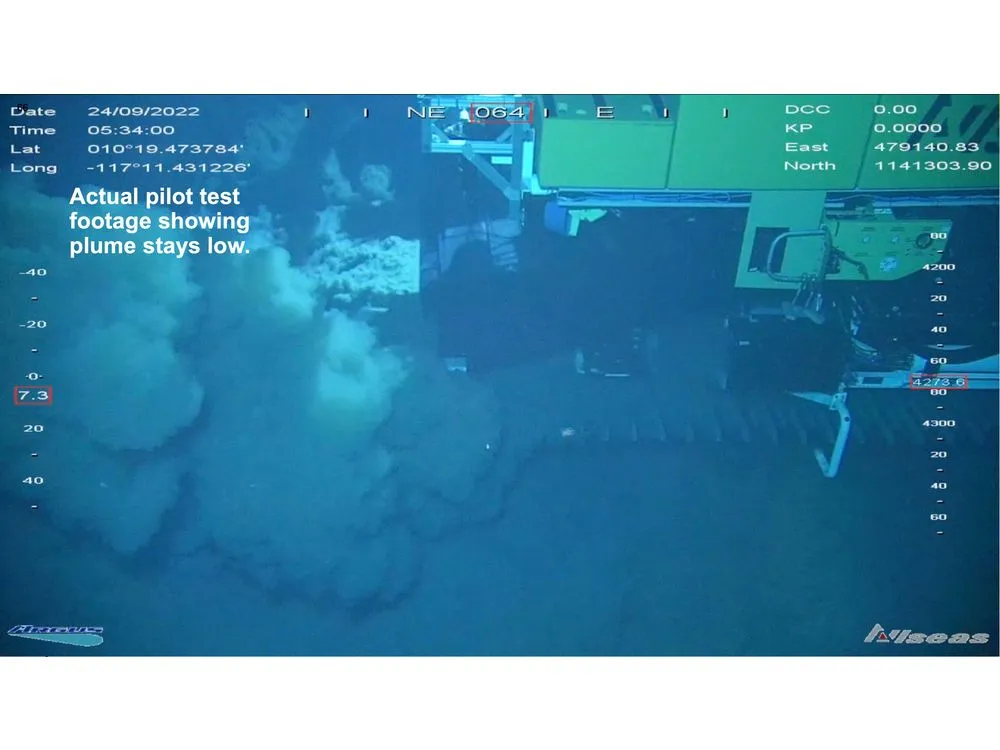

The Metals Company shared the results of their collector testing in the NORI-D license block in December 2023, which indicated that sediment plumes are not lifted into the water column and are not transported long distances.

Sediment plumes generated by nodule harvesting have been a cause of concern for deep sea mining companies. The process of harvesting nodules generates fine suspended sediments, which have the potential to travel long distances, enter the upper parts of the water column, and potentially disrupt the marine ecosystem. TMC conducted a collector test in 2022, in which they collected around 3000 tons of nodules, and consequently potentially generated a sediment plume. Their November/December 2023 offshore survey indicated that the plume generated was limited, that sediments were not lifted into the water column, and were not transported long distances.

Greenpeace Protests NORI-D Research Cruise

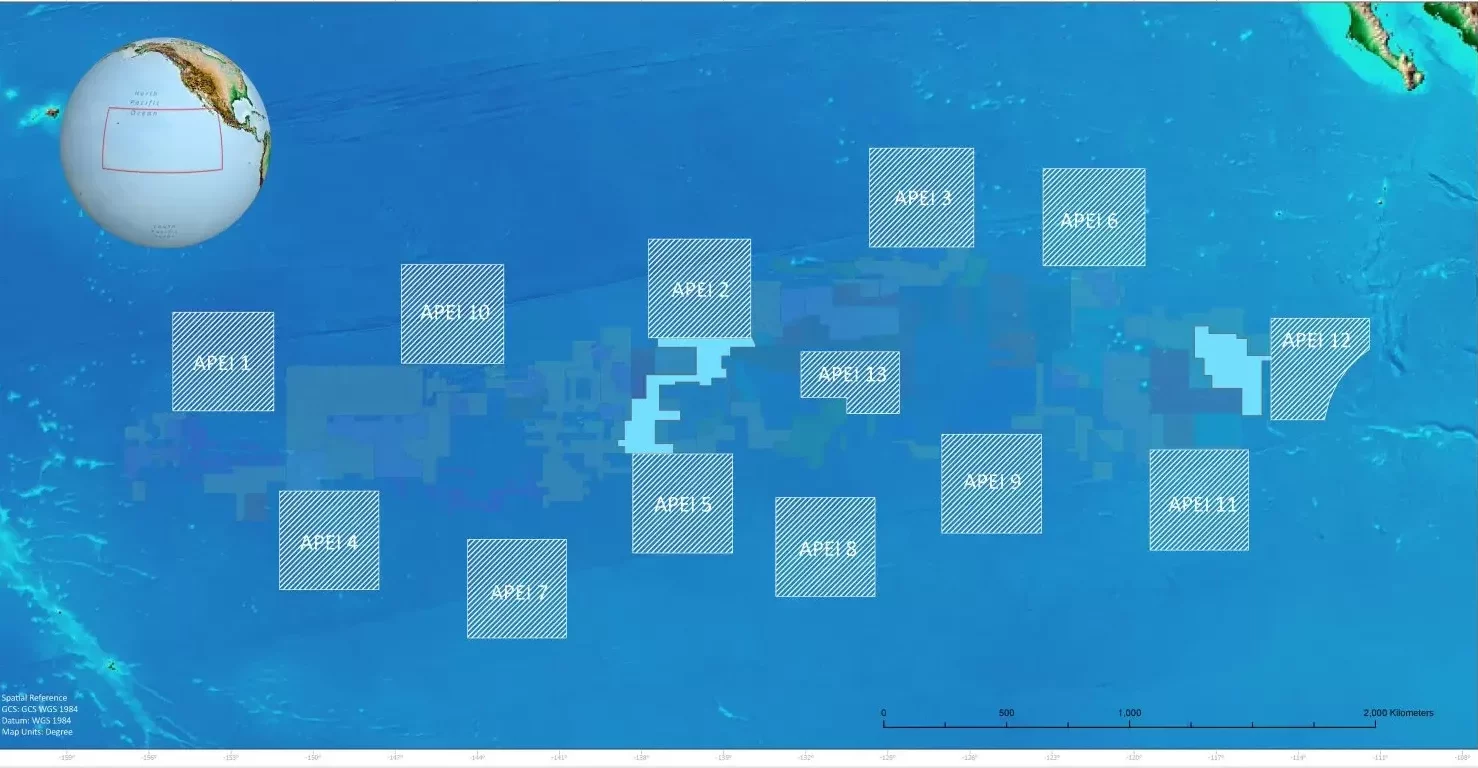

In November 2023, a significant incident occurred involving Nauru Ocean Resources Inc (NORI), a subsidiary of The Metals Company (TMC), and Greenpeace International in the NORI-D contract area in the Clarion Clipperton Zone (CCZ) in the Eastern Pacific Ocean.

On November 23, Greenpeace International activists protested around a ship conducting deep-sea ecosystem research for TMC. Activists paddled around the research survey vessel, MV COCO, displaying banners with messages like "Stop Deep Sea Mining", then subsequently invaded the ship and occupied a precarious position on a crane boom. The protest was intended to highlight the potential threats of deep-sea mining to ocean ecosystems.

TMC reported the disruption of its exploration activities to the ISA on November 25 and 26. They stated that Greenpeace's activities hindered independent scientists from conducting environmental and scientific studies to assess ecosystem function and recovery one year on from TMC's pilot nodule collection system test.

The District Court of Amsterdam subsequently ordered Greenpeace International to immediately disembark from the research vessel. Greenpeace complied with the court order.

Ongoing ISA Uncertainty

The International Seabed Authority missed the July 9th 2023 deadline to enact regulations for deep sea mining.

Back in 2021, the island state of Nauru triggered a treaty provision known as the "two-year rule" that required the ISA to finalize and adopt regulations for deep sea mining. This deadline was missed, meaning that applications for exploitation (mining or harvesting) can be submitted to the ISA for consideration and potential provisional acceptance.

The result is that subsea mining companies can hypothetically submit applications for mining. Practically, most have clearly state that they will defer their applications until the regulations have been finalized, but some have indicated that this is a courtesy.

Loke Acquired UKSR

Loke Marine Minerals (a Norwegian deep sea mining company) acquired UK Subsea Resources (a UK subsidiary of Lockheed Martin, the American defense contractor) in March 2023.

The purchase means that Loke now holds two contracts for the exploration for polymetallic nodules in the Clarion-Clipperton Zone.

China Continued Their Aggressive Posturing

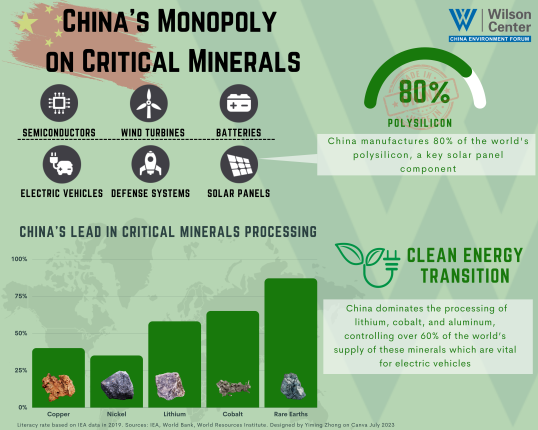

China continued to take an aggressive position on deep sea mining in 2024, causing concern for a number of countries and governments.

China has aggressively acquired subsea mineral licenses from the ISA in all three categories of subsea minerals (polymetallic nodules, seabed massive sulphides and cobalt-rich crusts) in a variety of jurisdictions, including the Clarion-Clipperton Zone, the Mid-Indian Ocean Ridge, and the Prime Crust Zone, via three companies (BPHDC, China Minmetals and COMRA).

In a further intriguing move, China widened their ban on exporting rare earth element technology. These moves are likely to place China in an even more dominant position around rare earth elements and other critical minerals.